flow through entity irs

Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446. A Flow-Through Entity Tax Your Payment Select Flow-Through Enti Enter your payment amounts in the Tax Amount Penalty Amount and Interest Amount fields for each tax type below.

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

A flow-through entity is also called a pass-through entity.

. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Unique Flow-Through Payors Tax Year 2000 K-1 Data Percent of each type in layers layer Partnership Trust S corp All FT Top 150 382 02 154. Flow-through entities are used for several reasons including tax advantages.

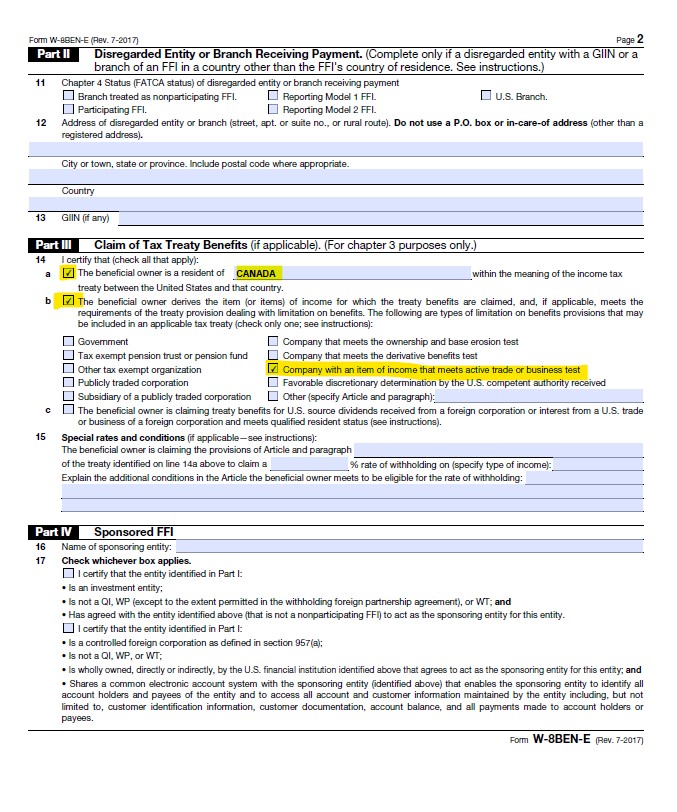

Click the payment button to initiate the payment. Instructions for Electing Into and Paying the Flow-Through Entity Tax. The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

The flow-through entity tax is retroactive to tax years beginning on and after January 1 2021. Flow-through entities FTEs affect an individuals Foreign Tax Credit FTC by impacting foreign source gross income foreign s ource. A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests.

Participate Any rental without regard to whether or not the taxpayer materially participates A single entity could have more than one activity. Payments made to a foreign intermediary or foreign flow-through entity are treated as made to the payees on whose behalf the intermediary or entity acts. City Individual Income Tax.

Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file. Any flow-through entity making a 2021 election after the due date of the flow-through entity tax annual return March 31 2022. City Business and Fiduciary Taxes.

The majority of businesses are pass-through entities. Flow-through Entity Tax Quarterly Estimated Tax Payments for Tax Years Beginning in 2021 Not Subject to Penalty or Interest. S corporation S corp.

If a payment category does not apply leave it blank. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Passive Activity A trade or business in which.

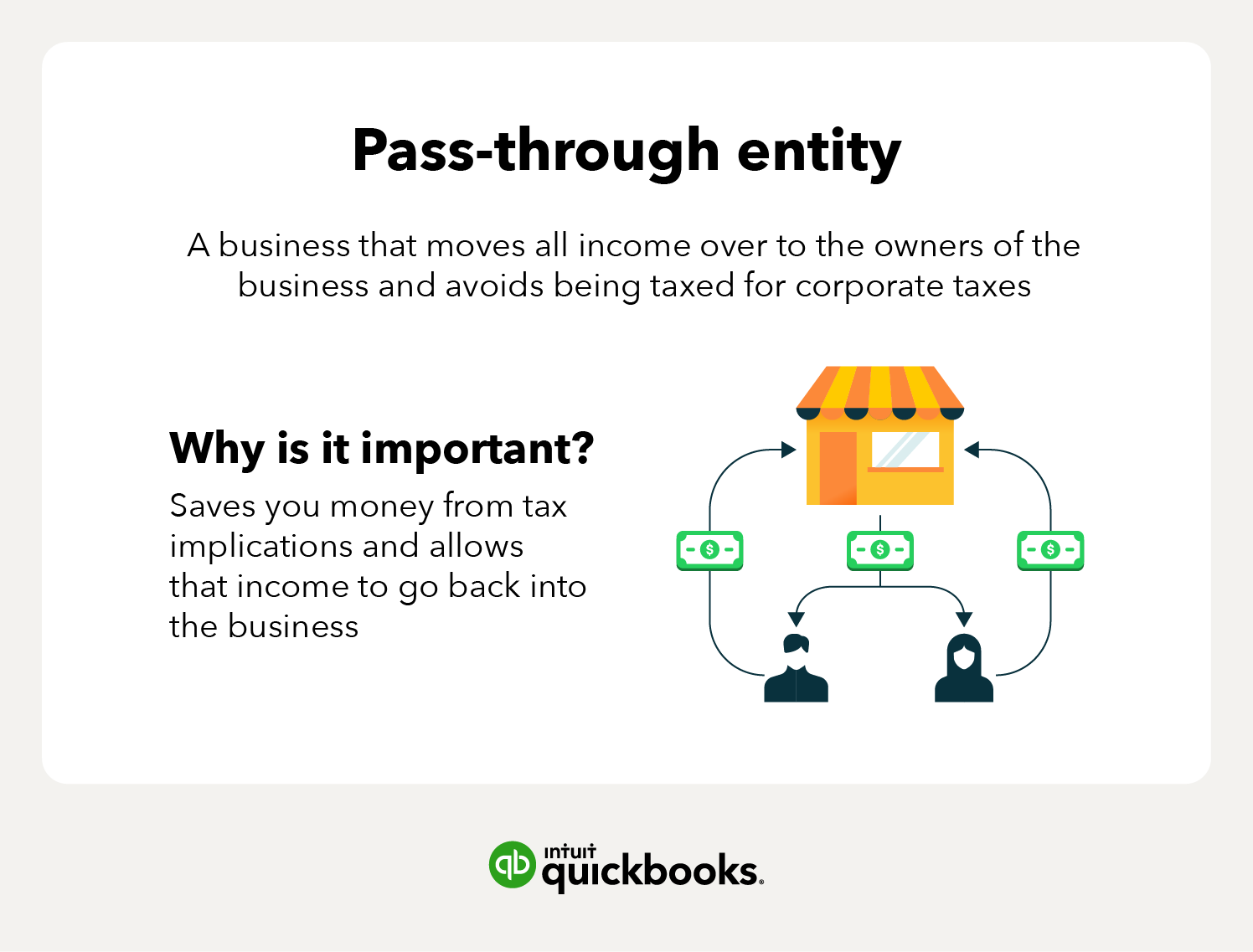

This guidance is expected to be published in early January 2022 and will be posted to the Departments website. A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. Its gains and losses are allocated.

000 Tax Type PAY Tax Amount 9 Flow-Through Entity Tax Select Pay. A form of LLC in which ownership is limited to certain. Understanding What a Flow-Through Entity Is.

This means that the flow-through entity is responsible for the taxes and does not itself pay them. City Individual Income Tax. This Practice Unit is updated to reflect the recent finalized Treas.

The income of the owners of flow-through entities are taxed using the ordinary. For further questions please contact the Business Taxes Division at 517-636-6925 and follow the prompts for Corporate. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated payments due for tax year 2021.

There are three main types of flow-through entities. Notice IIT Return Treatment of Unemployment Compensation. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right.

In the end the purpose of flow-through entities is the. Tiered Entities Material participation is based on the. The income of the business entity is the same as the income of the owners or investors.

Flow-through entities are considered to be pass-through entities. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Rules for Flow-Through Entities.

Types of flow-through entities. Common Types of Pass-Through Entities. Every profit-making business other than a C corporation is a flow-through.

Flow-Through Entity Tax Payments Due by March 15 2022 To Create a Member Income Tax Credit for Tax Year 2021. The continued levy of the tax is contingent upon the existence of the federal state and local tax SALT deduction limitation codified within IRC 164b6B. A business owned and operated by a single individual.

Flow-Through Entities Effects on FTC NOTE. Subsequent tax years is generally not. Estates and Trust Income Tax.

Branches for United States Tax Withholding provided by a foreign intermediary or flow. City Business and Fiduciary Taxes. An entity in which partners are not personally liable for the companys debt obligations.

Limited liability corporation LLC.

Instructions For Form 5471 01 2022 Internal Revenue Service

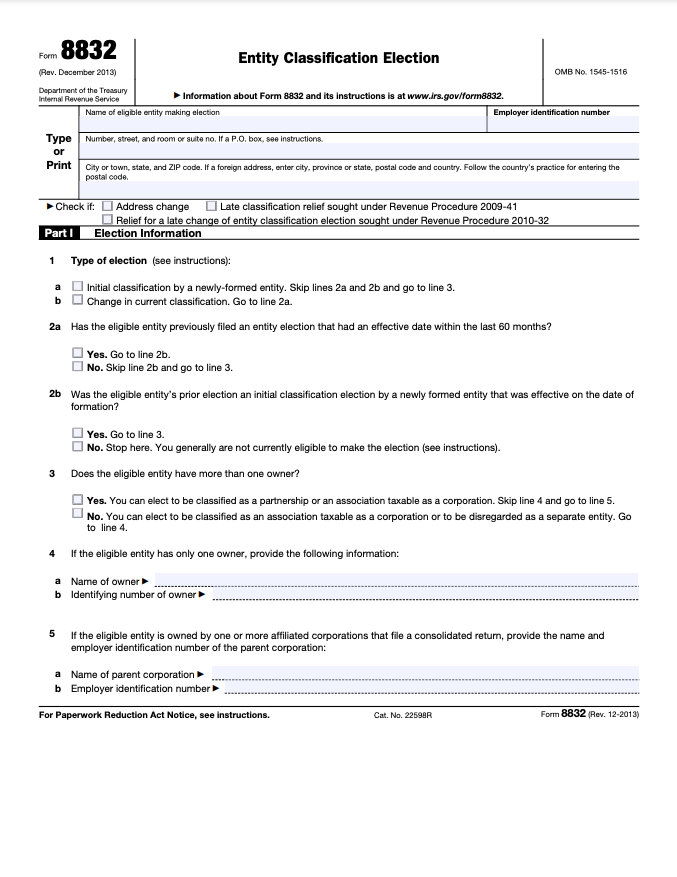

Form 8832 And Changing Your Llc Tax Status Bench Accounting

Form W 8ben Definition Purpose And Instructions Tipalti

Pass Through Taxation What Small Business Owners Need To Know

Instructions For Form 5471 01 2022 Internal Revenue Service

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Flow Through Entity Overview Types Advantages

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

Irs Form W 8imy Download Fillable Pdf Or Fill Online Certificate Of Foreign Intermediary Foreign Flow Through Entity Or Certain U S Branches For United States Tax Withholding And Reporting Templateroller

Irs Form 945 How To Fill Out Irs Form 945 Gusto

Form 8832 And Changing Your Llc Tax Status Bench Accounting

Form 8832 Instructions A Simple Guide For 2022 Forbes Advisor

How To Fill Out Irs Form 8858 Foreign Disregarded Entity Youtube

Form 8832 Instructions A Simple Guide For 2022 Forbes Advisor

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Pass Through Entity Definition And Types To Know Quickbooks